Design loans may have larger curiosity charges than typical property finance loan loans. The money may be compensated out in installments as design will get underway and continues in lieu of like a lump sum.

If the assets continues to be owned for less than a single calendar year, the lender need to look at the acquisition Charge as well as the documented rehabilitation costs for the utmost loan volume. You don't want to own an current FHA loan to use an FHA 203(k) loan for refinancing.

Forbes Advisor adheres to strict editorial integrity requirements. To the most beneficial of our information, all information is accurate as in the day posted, even though presents contained herein might now not be offered.

The house is then appraised to ascertain its latest worth and its projected worth following renovations. Depending on this, the loan total is calculated, making sure it falls in FHA loan restrictions.

As we’ve by now described, There are 2 sorts of 203(k) loans: Typical and Constrained. Although each enable you to finance renovations, the kind of do the job you are able to do will depend on which loan you select.

When you finally’ve Situated the lenders you’re enthusiastic about dealing with, it’s a smart idea to utilize with a number of of them. In this way, you’ll be able to check loan estimates and acquire the top house loan rate and least expensive fees.

Fannie Mae’s HomeStyle house loan The HomeStyle loan is a traditional loan that permits you to obtain and rehab a home with just five% down.

These are perfect for projects that demand a substantial sum upfront. The catch is you will need some home fairness prior to deciding to Enhance the house mainly because 2nd property finance loan lenders ordinarily lend up to 90% from the as-is property worth.

Dwelling fairness line of credit rating (HELOC) The house fairness line of credit history is a superb possibility once you will need adaptability and don’t have to borrow a good deal at the same time.

You are able to finance a contingency reserve fund In order for you. Even so, it could’t be a lot more than twenty% on the mend and enhancement finances.

Even so, these limitations increase to 30 days and nine months, respectively, for case figures assigned on or following November 4. You also can’t use this loan for landscaping or web-site enhancements.

With over a few decades of working experience crafting during the housing sector Place, Robin Rothstein demystifies home finance loan and loan concepts, assisting first-time homebuyers and homeowners make educated choices as they navigate the house loan marketplace. Her do the job...

An FHA 203(k) loan permits you to use resources for almost everything from minor mend needs to almost the entire reconstruction of a home, providing the original foundation is intact.

You’ll also require a minimum of a 3.5% down payment determined by the acquisition cost more info moreover maintenance costs, adequate revenue to repay the loan, rather than an excessive amount of current credit card debt. On top of that, you should be acquiring a house you propose to are in.

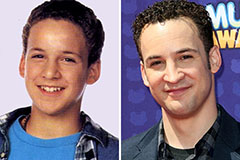

Ben Savage Then & Now!

Ben Savage Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Nadia Bjorlin Then & Now!

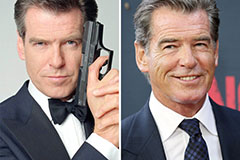

Nadia Bjorlin Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!